Your Trusted Tax & Accounting Partner in Ocklawaha, FL

Bill Fox Tax & Accounting Inc., established in 1993, is a locally owned and operated firm located in Ocklawaha, FL. For over 30 years, we have been committed to providing comprehensive tax and accounting solutions tailored to meet the unique needs of both individuals and businesses. Our experienced team of professionals is dedicated to helping you navigate the complexities of tax planning, accounting, and financial management with ease and confidence.

Why Choose Bill Fox Tax & Accounting Inc.?

Experience & Expertise: With over 30 years of experience, our knowledgeable team is equipped to handle all your tax and accounting needs.

Client-Focused Approach: We prioritize our clients’ success and work diligently to provide personalized solutions that align with your goals.

Comprehensive Services: From tax preparation to HR consulting, we offer a full range of services to support both individuals and businesses.

Local & Accessible: As a locally owned business, we understand the unique needs of our community and are always here to help.

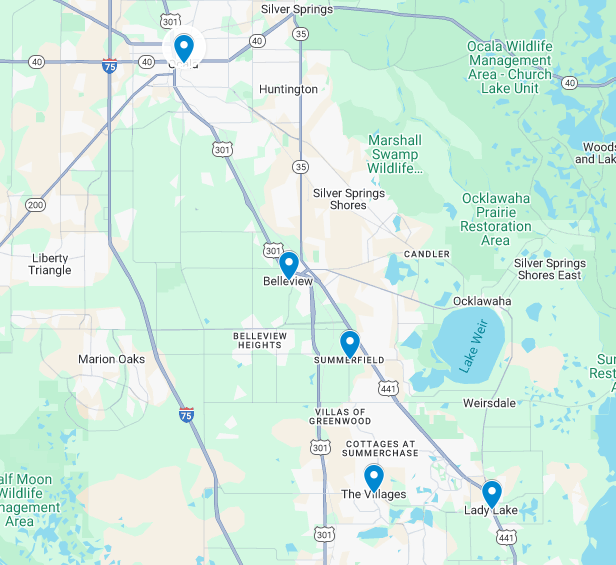

Serving Ocklawaha & Surrounding Areas

Bill Fox Tax & Accounting Inc. proudly serves clients in Ocklawaha, as well as the surrounding areas of Belleview, Lady Lake, The Villages, Ocala, and Summerfield, FL. We are dedicated to building long-term relationships with our clients and are committed to helping you achieve financial success.

See What Our Clients Are Saying

Frequently Asked Tax & Accounting Questions

What should I bring to my tax preparation appointment?

Bring all relevant financial documents, including W-2s, 1099s, receipts, and any other income or expense records.

How can your bookkeeping services benefit my business?

Our bookkeeping services ensure accurate financial records, which help in making informed business decisions and maintaining compliance with tax regulations.

What areas do you serve?

We serve Ocklawaha, Belleview, Lady Lake, The Villages, Ocala, and Summerfield, FL.

Can you assist with setting up a new business?

Yes, we offer new business startup consulting to guide you through the setup process, including choosing the right business structure and financial planning.

Do you offer payroll services for small businesses?

Yes, our payroll services are tailored to meet the needs of small businesses, ensuring compliance and accuracy in employee compensation.

How often should I update my business accounting records?

It is recommended to update your accounting records at least monthly to ensure accuracy and timely decision-making.

1. What types of tax services does Bill Fox Tax & Accounting offer for individuals and businesses?

At Bill Fox Tax & Accounting Inc., we provide comprehensive tax services including individual tax preparation, business tax planning and filing, states & federal compliance, year-round tax strategy, and audit support. Whether you’re a sole proprietor, shareholder of an S-Corp/LLC, or an individual seeking to optimize your return, we tailor our approach to your unique financial situation.

2. How can your tax planning services help me minimize my tax liability?

Effective tax planning means looking ahead—tracking recent tax law changes, identifying credits and deductions, structuring business entities appropriately, and advising on timing of income/expenses. Our team stays current on tax regulations to help you legally reduce taxes and keep compliance intact.

3. What kind of bookkeeping and payroll support does Bill Fox Tax & Accounting provide?

We offer accurate, timely bookkeeping including account reconciliation, financial reporting, and payroll management (employee pay, tax filings, compliance). Outsourcing bookkeeping and payroll to us means your business records are reliable, letting you focus on growth rather than daily admin.

4. I’m starting a new business — what startup consulting do you offer?

For new business owners in Ocklawaha and surrounding areas, we assist with entity selection (LLC, S-Corp, etc.), tax registration, setting up accounting systems, budgeting and cash flow planning. Starting off right with good structure reduces future headaches and tax surprises.

5. Which geographic locations do you serve?

Bill Fox Tax & Accounting Inc., located in Ocklawaha, FL, serves clients in Ocklawaha, Belleview, Lady Lake, The Villages, Ocala, and Summerfield, FL. Having a local presence means we understand Florida tax regulations and community-specific business contexts.

6. Do you provide services for both individuals and businesses?

Yes. We support both individuals (W-2 employees, retirees, self-employed) and businesses (small to medium companies, startups). Whatever your financial profile, we craft personalized tax and accounting strategies that align with your goals.

7. How do I prepare for my tax preparation appointment with you?

Bring your W-2s, 1099s, other income statements, receipts for deductible expenses, asset purchase records, previous years’ returns, and relevant business documents if applicable. The more organized you are, the faster and more accurate your return will be.

8. What happens if I’m audited — can you help?

Yes. If you receive an audit letter from the IRS or state tax agency, we can assist you through the process — reviewing your records, preparing response documentation, and guiding you through audit procedures to ease stress and reduce risk.

9. How often should my business update its accounting and bookkeeping records?

Ideally monthly. Regular updates allow you to monitor cash flow, make informed decisions, stay tax-compliant, and avoid end-of-year surprises. Our team recommends consistent bookkeeping to keep your business healthy and ready for tax season.

10. What are the benefits of HR consulting through your firm?

Our HR consulting helps businesses with recruitment strategies, employee benefits planning, compliance with labor laws, development of policies and procedures, and strategic workforce management. A solid HR function supports business growth and reduces liability.

11. How do you stay up to date with changing tax laws and regulations?

We monitor federal, state (Florida), and local regulatory changes continuously, attend trainings, and leverage professional networks to ensure our clients benefit from the latest tax strategies and maintain full compliance.

12. What sets Bill Fox Tax & Accounting Inc. apart from other firms?

With over 30 years of experience, a client-focused approach, deep local understanding of the Ocklawaha-region business environment, and a breadth of services (tax, accounting, HR, payroll), we offer the convenience of a full-service firm with the personal touch of a local partner.

13. How do I schedule a consultation or engagement with your firm?

You can call us at (352) 572-5732, email info@billfoxtaxandaccounting.com, or use the contact form on our website to book an appointment. We welcome both new clients and businesses seeking an accounting partner in the Ocklawaha region.

14. What does your service fee structure look like?

Our fees depend on the complexity of the services required—whether it’s simple individual tax filing, business tax strategy, full bookkeeping and payroll, or HR consulting. We provide transparent quotes and detailed service scopes ahead of engagement so you know what you’re paying for.

15. I’m relocating to Florida — how does that affect my tax and accounting needs?

Moving to Florida (or setting up a business here) presents unique tax/accounting considerations—state tax implications, registration of your business in Florida, local compliance, residency determinations, and changes in deductible state taxes. We help you navigate these transitions smoothly so your tax strategy aligns with your new residence or business location.

Ready to take control of your financial future? Contact Bill Fox Tax & Accounting Inc. today at 352-572-5732 to schedule a consultation. Let us be your partner in success.